The conclusion of the study published by Nergica in May 2021 is unequivocal: Quebec has a strong but currently under-exploited solar potential. A number of businesses in the province have been working in the solar sector for years. We contacted the representatives of four such companies to learn more about Quebec’s solar industry and their vision of how it might evolve in the years to come.

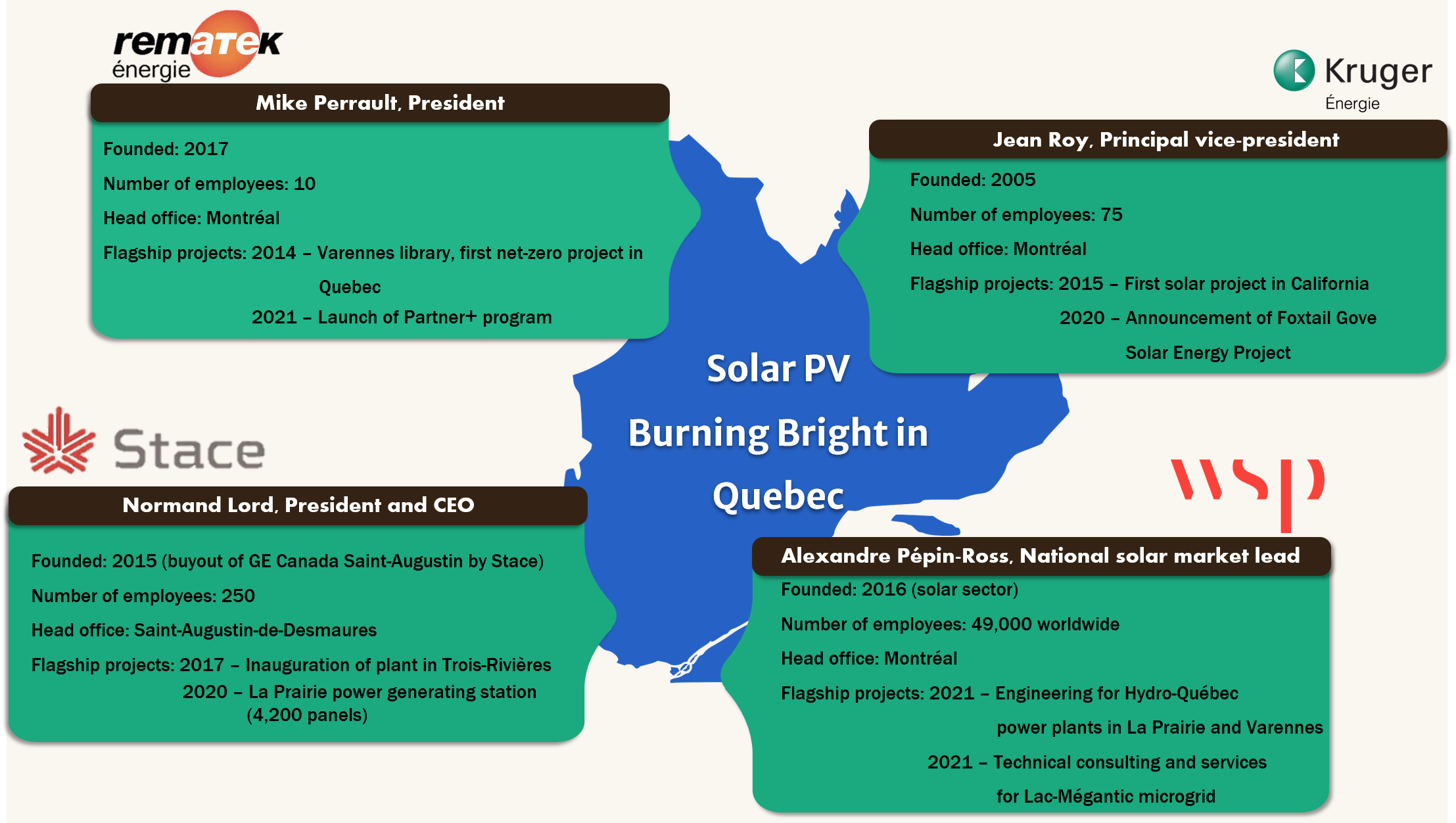

Interviews with Jean Roy, senior vice president at Kruger Energy; Mike Perrault, president of Rematek Energy; Normand Lord, chief executive officer at STACE; and Alexandre Pépin-Ross, national solar market lead until recently at WSP and board member of the Association québécoise de la production d’énergie renouvelable (AQPER). We discussed the expansion of the photovoltaic (PV) sector in Quebec and the few clouds that are hindering the development of the solar industry.

Doing business in Quebec: pluses and minuses

Good access to engineering expertise, a qualified labour force as well as low-cost, green electricity makes Quebec a prime region for solar developers. These advantages make it possible to offer competitively-priced engineering services while maintaining a low carbon footprint. Furthermore, Quebec is emerging as a dynamic and attractive hub for PV research and development due to the number of key players that have set up shop in the province and the flagship projects being completed here.

According to Alexandre Pépin-Ross, “The effervescence of the business world with respect to renewables and the synergy between partners are truly unique.” Notably, Mr. Pépin-Ross mentions the AQPER and the Association de l’industrie électrique du Québec (AIEQ) as incubators of collaboration. Solar research at the college and university levels, especially at Cégep de la Gaspésie et des Îles (by Nergica) and at Université de Sherbrooke, is also spawning numerous opportunities for technological innovation and enables organizations to recruit qualified personnel.

However, according to Kruger Energy’s Jean Roy, not only are the absence of competition with Hydro-Québec and the current pricing structure not particularly favourable to the deployment of renewables, they also represent a hindrance to innovation. Mr. Pépin-Ross adds that the energy context in Quebec is currently not conducive to solar and wind power development, which explains why the majority of WSP’s projects lie outside the province. Quebec’s legal framework also represents a hurdle for the PV sector. “The current legal structure does not yet allow solar to fully flourish. Nevertheless, we are convinced that Quebec is a promising location for this energy source and for the development of new technologies. Quebec is a pioneer in technological innovation in the field of electricity,” affirms STACE CEO Normand Lord.

However, according to Kruger Energy’s Jean Roy, not only are the absence of competition with Hydro-Québec and the current pricing structure not particularly favourable to the deployment of renewables, they also represent a hindrance to innovation. Mr. Pépin-Ross adds that the energy context in Quebec is currently not conducive to solar and wind power development, which explains why the majority of WSP’s projects lie outside the province. Quebec’s legal framework also represents a hurdle for the PV sector. “The current legal structure does not yet allow solar to fully flourish. Nevertheless, we are convinced that Quebec is a promising location for this energy source and for the development of new technologies. Quebec is a pioneer in technological innovation in the field of electricity,” affirms STACE CEO Normand Lord.

For Rematek Energy’s Mike Perrault, doing business in the province is win-win from every angle. Given that Hydro-Québec’s energy surplus is expected to be absorbed by 2026 and that solar is able to alleviate demand during peak periods, PV technology is well suited to play an important role in Quebec’s energy mix. The French language is also a leading argument for Rematek Energy, which is looking to break into markets in Africa.

A bright future for solar in Quebec?

All of the industrial players interviewed are convinced that in these times of rising energy demand, the development of solar PV in Quebec is poised to take off. However, this may take some time given the electricity surplus, installation costs, the legal framework in place and current government investments.

“Solar PV production costs have dropped significantly between 2010 and 2020, making it a competitive and consequently all the more attractive form of energy for Quebec. In fact, by 2030, the cost of solar will be comparable if not less than that of other renewable energy technologies available in the province. Since 2018, the cost of energy from certain solar PV installations in the residential sector has reached parity with Hydro-Québec’s rates,” argues Karim Belmokhtar, Nergica’s senior project manager for research and innovation and author of the study published last May.

It is worth mentioning that Quebec enjoys similar irradiation levels as those of Japan and Germany, both of which are global leaders in the field of solar PV. Furthermore, low-temperature PV modules actually perform better in this Canadian province. Lastly, increasingly popular bifacial panels can help offset snow-related losses. Quebec therefore checks all the boxes to attract solar investment!

In light of current PV installation costs, the cost of hydroelectricity and Hydro-Québec’s pricing structure for surplus output, self-generation is not necessarily the preferred solution for residential and commercial buildings. On the other hand, PV technology might experience considerable success in off-grid networks, points out Jean Roy. For grids that currently rely on fuel combustion, the economic and environmental benefits could be more significant. Mr. Perrault and Mr. Pépin-Ross add that Hydro-Québec is increasingly interested in solar and the utility is already collaborating on a number of projects with companies both in and outside the province. “I am very pleased with what has transpired in the past two years. As nearly all energy development goes through Hydro-Québec, it was interesting to see the utility become more open to this new sector,” declares Mr. Pépin-Ross.

In the longer term, the end of the energy surplus anticipated by Hydro-Québec for 2026 might bode well for the commissioning of solar plants as well as self-generation. Mr. Lord and Mr. Perrault are optimistic that Quebec will see increased PV installations – whether on the rooftops of local residential and commercial buildings or in the form of mini solar arrays for neighbourhoods – as well as solar plants developed in collaboration with Hydro-Québec.

STACE’s CEO adds that with capital costs for solar being lower than those of large hydro infrastructure, solar may be able to carve out a niche in Quebec’s energy portfolio. PV installations might also “contribute to grid resilience by using hydro plants like a large environmentally-friendly battery.”

Mr. Lord also touches upon the redevelopment of abandoned land near residential neighbourhoods as an argument for the advancement of PV technologies in Quebec and mentions STACE’s ongoing projects in France. The installation of a 60 MW solar farm on the site of a former landfill is expected to be completed by the end of 2021, at which time it will be able to supply power to 70,000 residents of Bordeaux.

The representatives of WSP and Rematek Energy also point out that the popularity of energy storage might allow solar to gain a stronger foothold in Quebec. Mr. Pépin-Ross indicates that “At the residential level, it would be wise to evaluate the use of bidirectional charging stations for the distribution network and to use EV batteries to support peak demand.”

What’s missing for Quebec to capitalize on its solar potential?

The representatives of Rematek Energy, STACE and WSP are convinced that financial barriers are stymieing the development of solar in the province. Nearly non-existent financial incentives do not stimulate self-generation and government investments remain sluggish. It is also difficult for solar modules to compete with hydroelectric dams. Mr. Pépin-Ross suggests that it would be advisable to launch a call for tenders specifically for solar in order to prioritize this technology and give it a chance to succeed in Quebec. This would subsequently pave the way for the completion of other projects. Experts from the panels organized by Nergica for the release of its solar study also suggested that dedicated tenders might help propel this energy source. A summary of these panels as well as exchanges on the future of solar PV are available here.

Another point that frequently comes up when people mention solar deployment in Quebec is the Hydro-Québec monopoly. Jean Roy of Kruger Energy explains that Hydro-Québec’s control over retail sales and its lacklustre interest in solar makes development in this sector difficult. He advocates establishing more generous and flexible pricing conditions for self-generation in order to develop the sector. A feed-in tariff program would also help kick-start the industry.

Normand Lord of STACE explains that, considering current electricity rates in Quebec, the return on investment for the purchase and installation of solar panels is approximately 12 years. Rematek Energy President Mike Perrault adds that the 20 kW and 50 kW net metering limits imposed by Hydro-Québec for single- and multi-phase current – i.e. the injection of surplus private power production into the Hydro-Québec grid in exchange for credit – is also a limiting factor for the deployment of solar installations for commercial buildings.

Further, Mr. Perrault proposes implementing a sort of carbon tax that would help accelerate the energy transition by penalizing more polluting, fossil-based generation.

Ramping up the contribution of renewables to energy production in Quebec will require a change of current habits and models. Mr. Lord affirms that “If the market were to open up, if more people were to install residential solar panels and if Hydro-Québec were to become like a sort of giant battery, the utility would be able to change the way it charges for this service.”

Forecast: future bright for Quebec’s solar sector

Despite a few dark clouds overhead, solar power has a promising future in Quebec. The industry is hopeful that the aforementioned suggestions and the recommendations made in Nergica’s solar study will be taken into consideration by decision-makers. The interviews conducted confirm that Quebec is a choice location for the PV sector, whether it be for engineering firms or PV technology manufacturing or installation companies.

Presently, the barriers to deployment appear to be more financial and legal in nature rather than technical or social. With the exception of the harsh Quebec winters – which will require that a certain expertise be developed for operating PV in cold climate conditions – the technology exists and is ready to be deployed. “There’s no need to reinvent the wheel,” quips Mike Perrault, “just look at what has been happening in Scotland over the past 20 years.” Solar also enjoys strong interest and social acceptability in Quebec. And thanks to irradiation levels in the province, solar is on the cusp of making a breakthrough in the energy market.

As pointed out by Kruger’s Jean Roy, Hydro-Québec’s current monopoly on energy production in Quebec is hampering the uptake of PV technology, though a surge in interest in self-generation might be observed if the provincial utility were to show greater flexibility and offer more advantageous pricing conditions. It remains to be seen how the relationship between Hydro-Québec and prosumers, i.e. individuals that produce and consume energy, will evolve as energy generation trends toward decentralization.

Time will tell what role solar will play in Quebec’s energy mix. What is clear, however, is that the sector is already prospering thanks to the expertise of our citizens and the dynamism of numerous local players that are demonstrating innovation and ambition.

As pointed out by Alexandre Pépin-Ross, “In any field, the more projects there are, the lower the costs will be. We need to allow solar technology the time and space to prove its value and relevance in the Quebec energy mix.”

To learn more about these four Quebec-based companies that are putting the province’s solar industry on the map, you can consult the article Profiles of Four Quebec-based Companies Driving the Solar PV Sector. Also recommended is Nergica’s study Solar Photovoltaics in the Quebec, Canadian and global energy mix – Analysis and Outlook which discusses solar PV and its place in the Quebec, Canadian and global energy mix.